GOCARDLESS API

Build better, smarter, faster with our API

Collect bank debit payments across 30+ countries from a single, hassle-free integration.

We speak your language

Client libraries for PHP, Java, Ruby, Python, and .NET

Simple to develop & test

End-to-end testing in our free sandbox environment

API-first technology

Clean, modern RESTful API built from the ground up

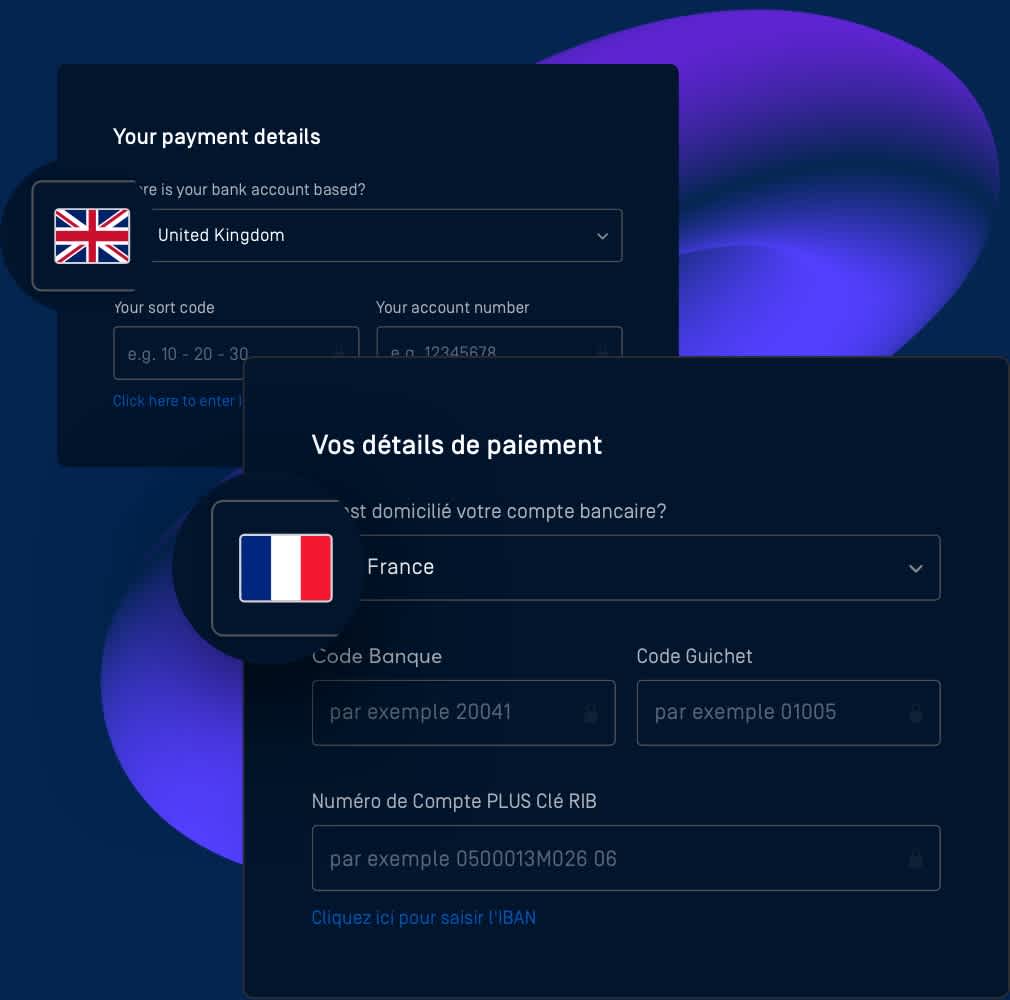

International payments

Localised payments for 30+ countries in a single integration.

Simple to integrate

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-CA] nwe-code_summary_block](https://images.ctfassets.net/40w0m41bmydz/1kaKsLoDerAnQ3fqECiYOa/1baadedf7b182dd0b2d878ecceebfa26/nwe-en-api-subscription-xs_2x-EN-AU.png?w=670&h=656&q=50&fm=png)

![[en-CA] nwe-code_summary_block](https://images.ctfassets.net/40w0m41bmydz/65RjwIwGXwMXLqM1pWu1X3/2f4974c99eb5d7691355732e811df68c/nwe-en-api-subscription_4x-EN-AU.png?w=670&h=697&q=50&fm=png)

Made for recurring payments

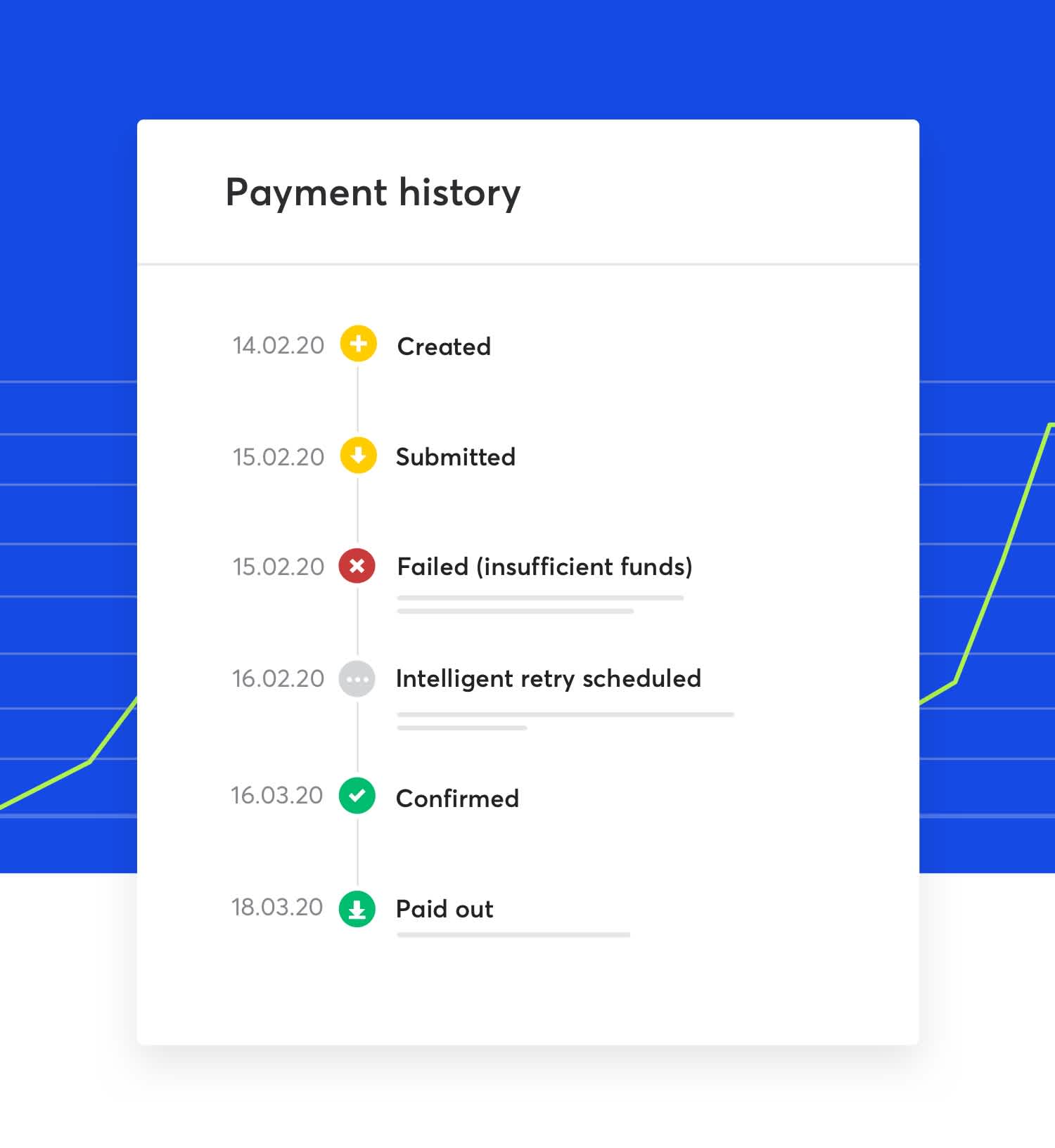

97.3% payment success

GoCardless customers can enjoy a payment success rate of 97.3% at the first attempt.

Intelligent payment retries

Success+ uses recurring payment intelligence to schedule payment retries on the optimal day for each customer. Reduce your failure rate by a further 15% with Success+.

Collect international payments

Provide a great payment experience for customers in over 30 countries including the UK, Eurozone countries, the USA and Australia.

Moving to GoCardless was the natural step in our payments evolution to allow us to scale, without payments being the limiting factor.

Chris Latchford, Global Head of Payments Strategy, Funding Circle

Made for payment success

Collect 97.3% of payments successfully, at the first time of asking. When a payment does fail, sit back and let Success+ schedule payment retries on the best day for each customer.

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally-recognised international standard.

GDPR compliant

The GoCardless global data risk management programme is built to strict GDPR standards and applies privacy best practices to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $13bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

When your engineers actively want to integrate with GoCardless, you know it’s a scalable solution.

Peter Vanhee, Head of Technology, Comic Relief

A robust set of tools and resources

Expert developer support

Our team of API specialists is on hand to answer queries and offer support as you’re building your integration.

Free sandbox environment

End-to-end testing in our free sandbox environment

Copy and paste code samples

We’ve worked hard to make building with our API as painless as possible.

Clear documentation

Full reference documentation including step by step guides.

Trusted by over 70,000 businesses worldwide

Want to learn more?

Speak to our payment experts today about your payment challenges, and see how we can help.