GoCardless API

Build better, smarter, faster with our API

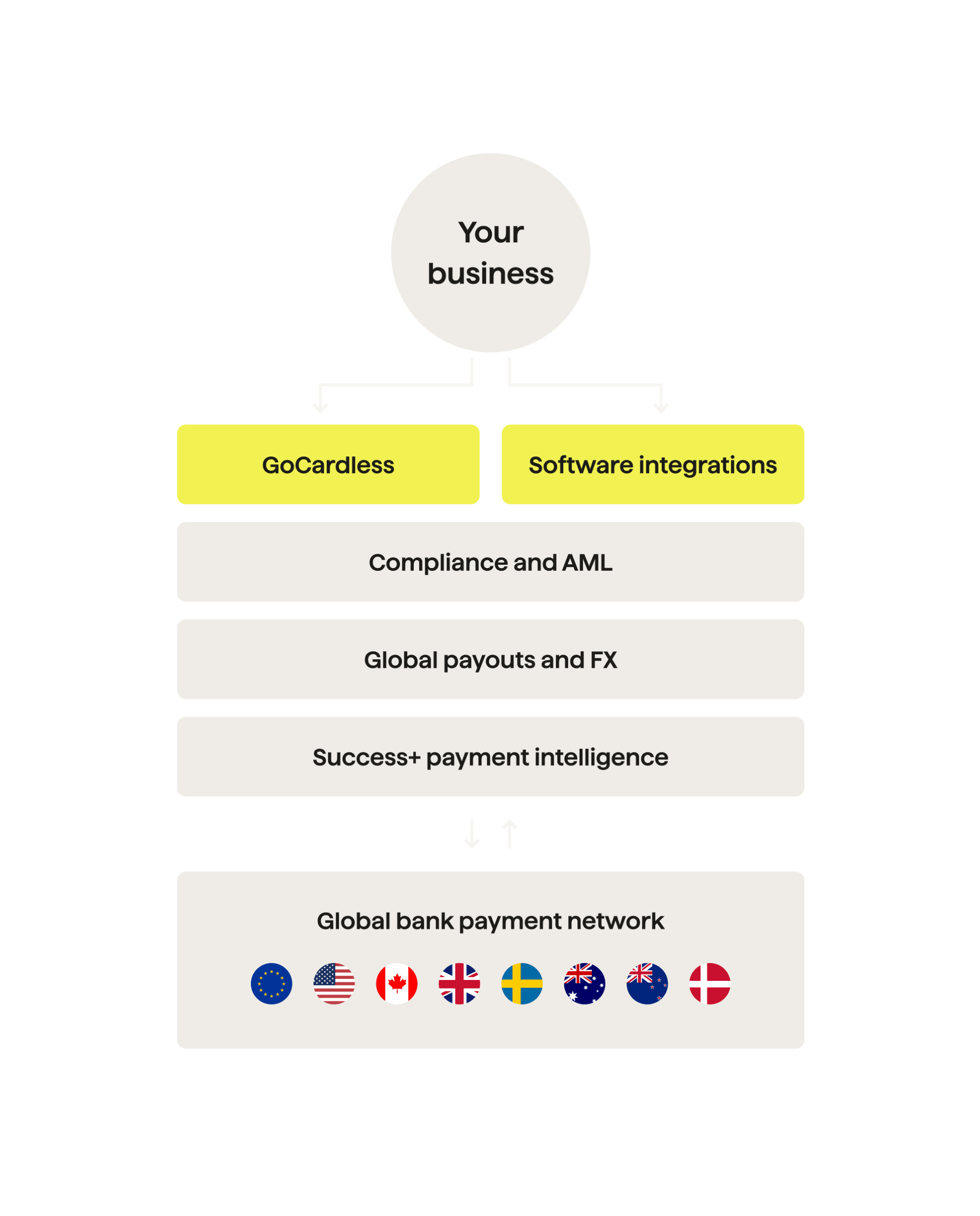

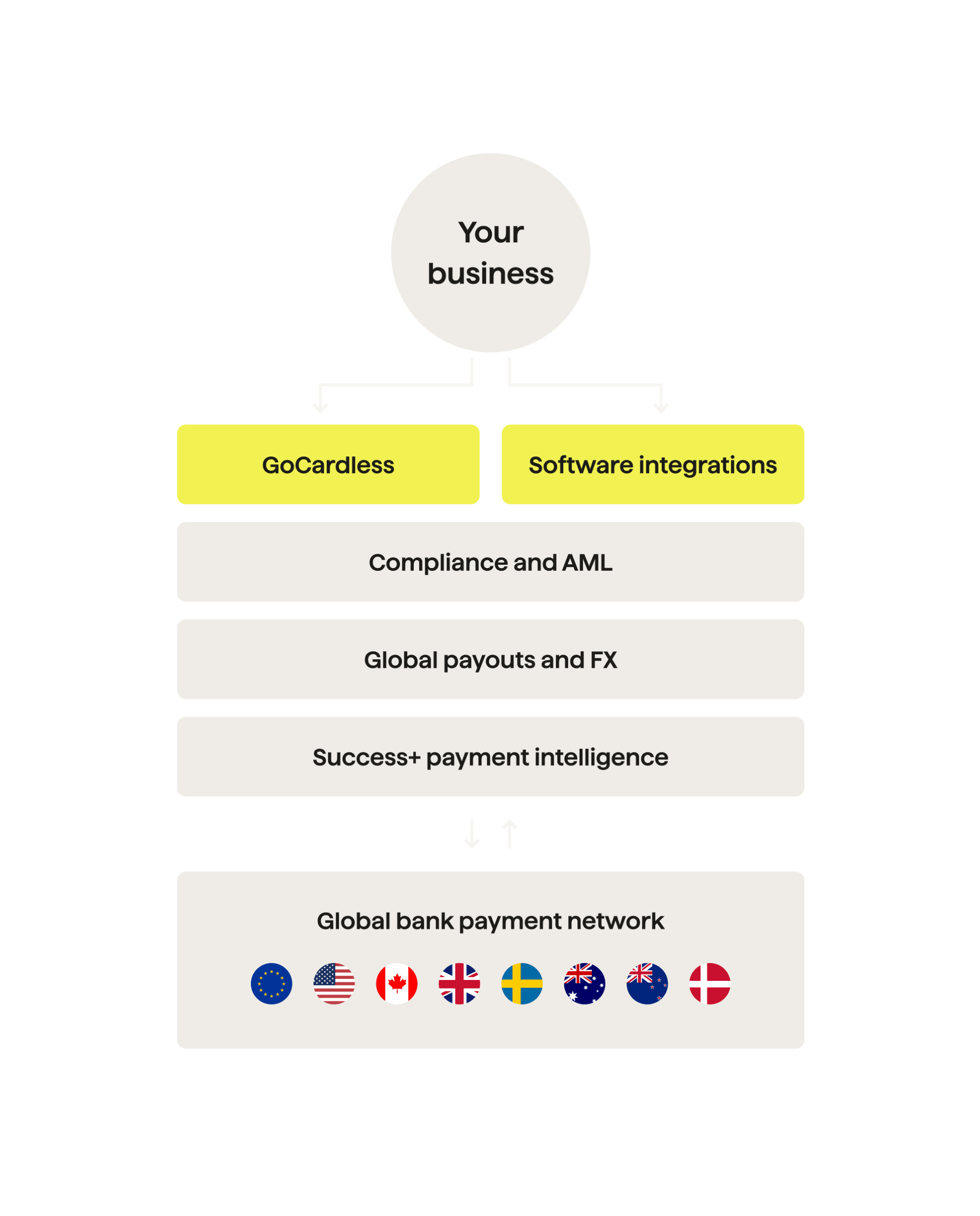

Collect payments across 30+ countries from a single, hassle-free integration.

We speak your language

Client libraries for PHP, Java, Ruby, Python, and .NET

Simple to develop & test

End-to-end testing in our free sandbox environment

API-first technology

Clean, modern RESTful API built from the ground up

International payments

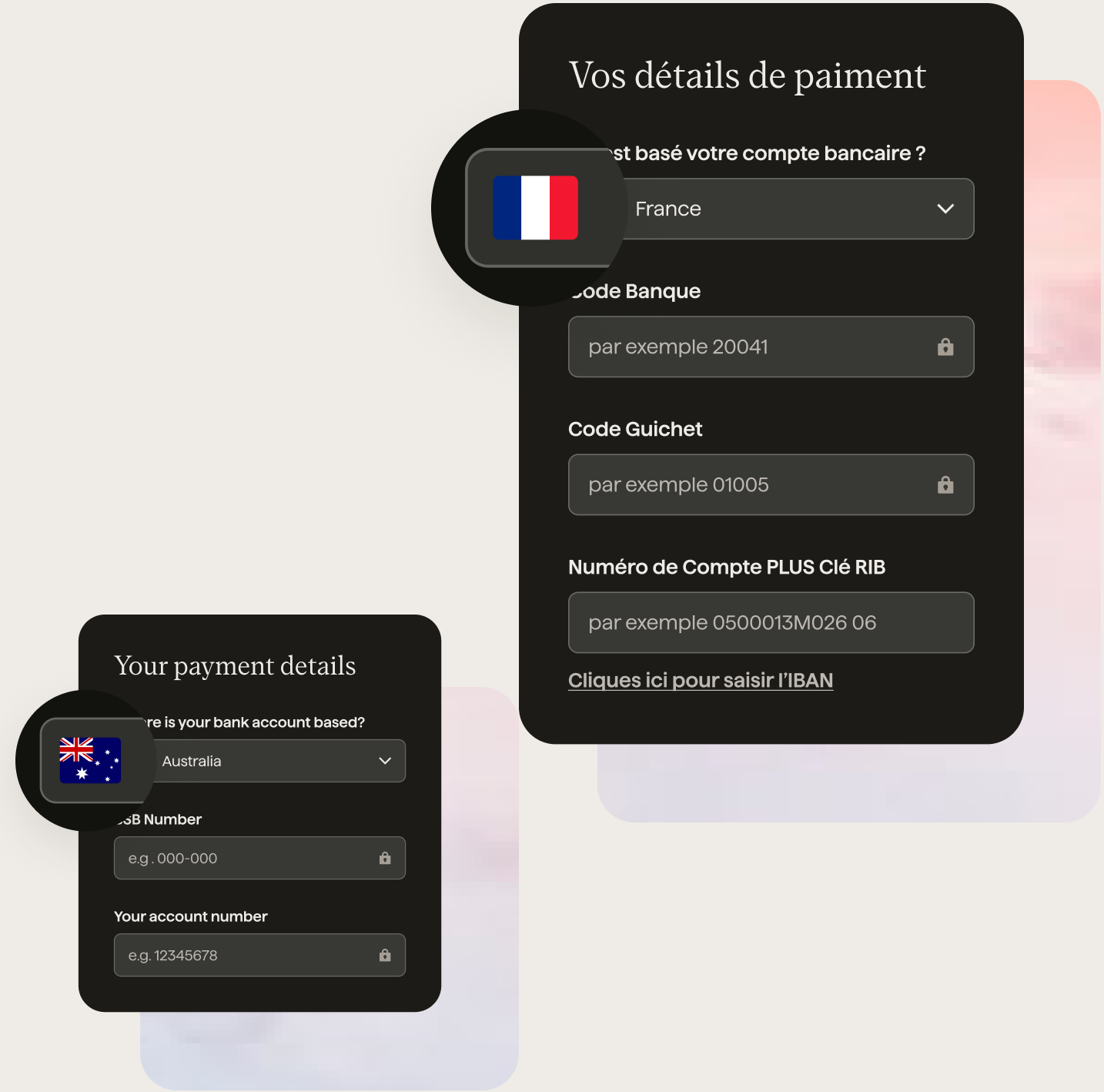

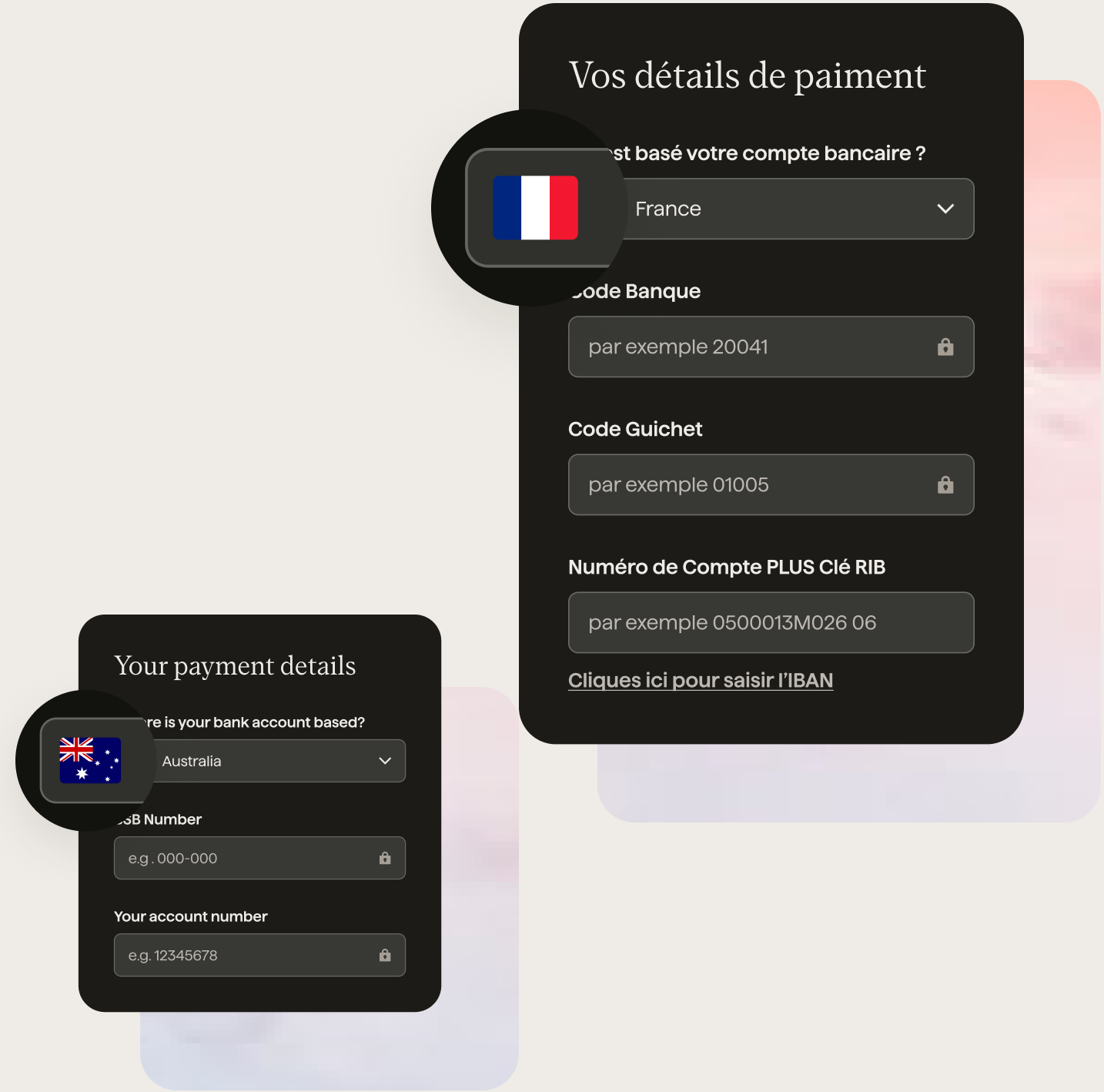

Localised payments for 30+ countries in a single integration.

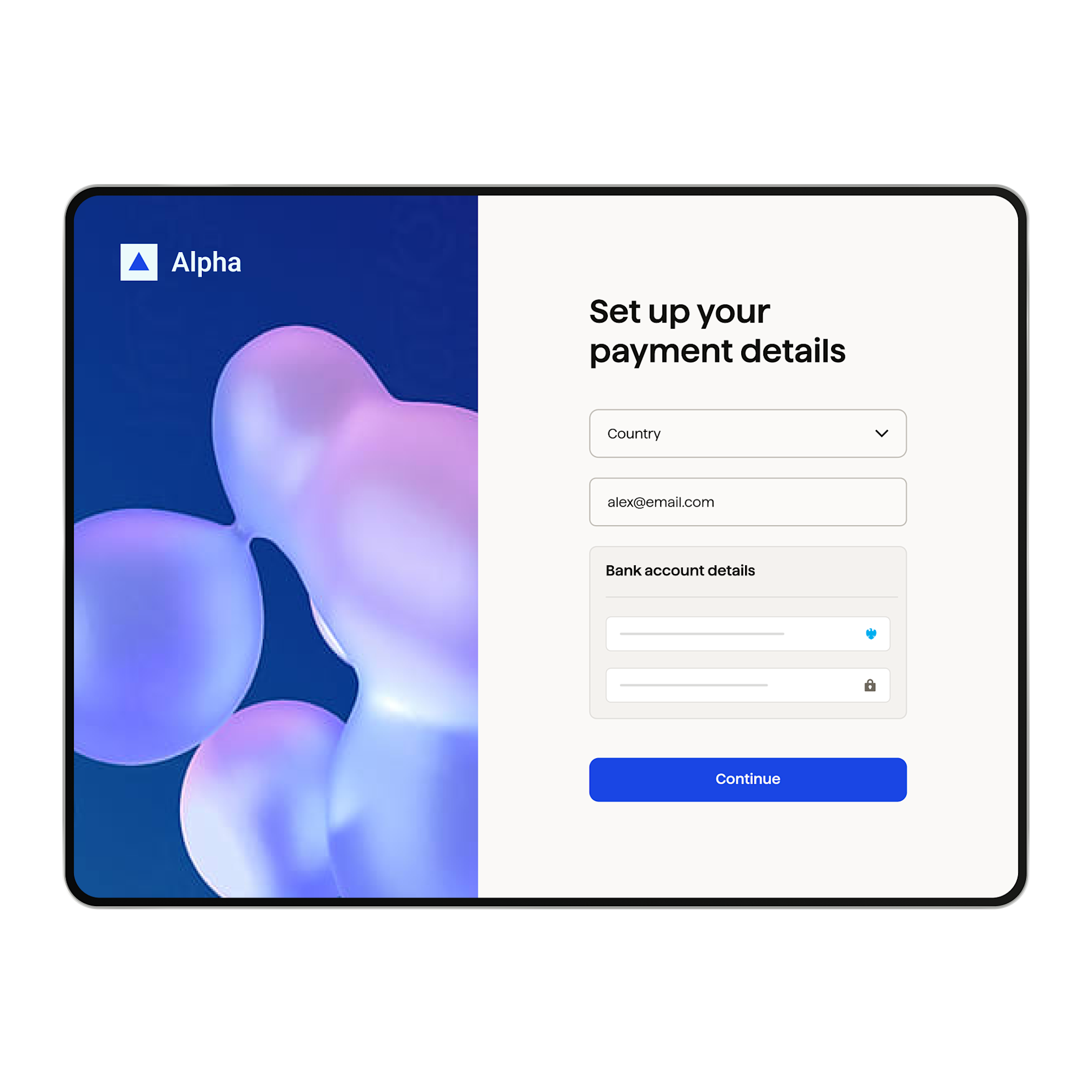

Simple to integrate

Made for recurring payments

Collect international payments

Create a great payment experience for customers in over 30 countries including the UK and Europe, the USA and Australia.

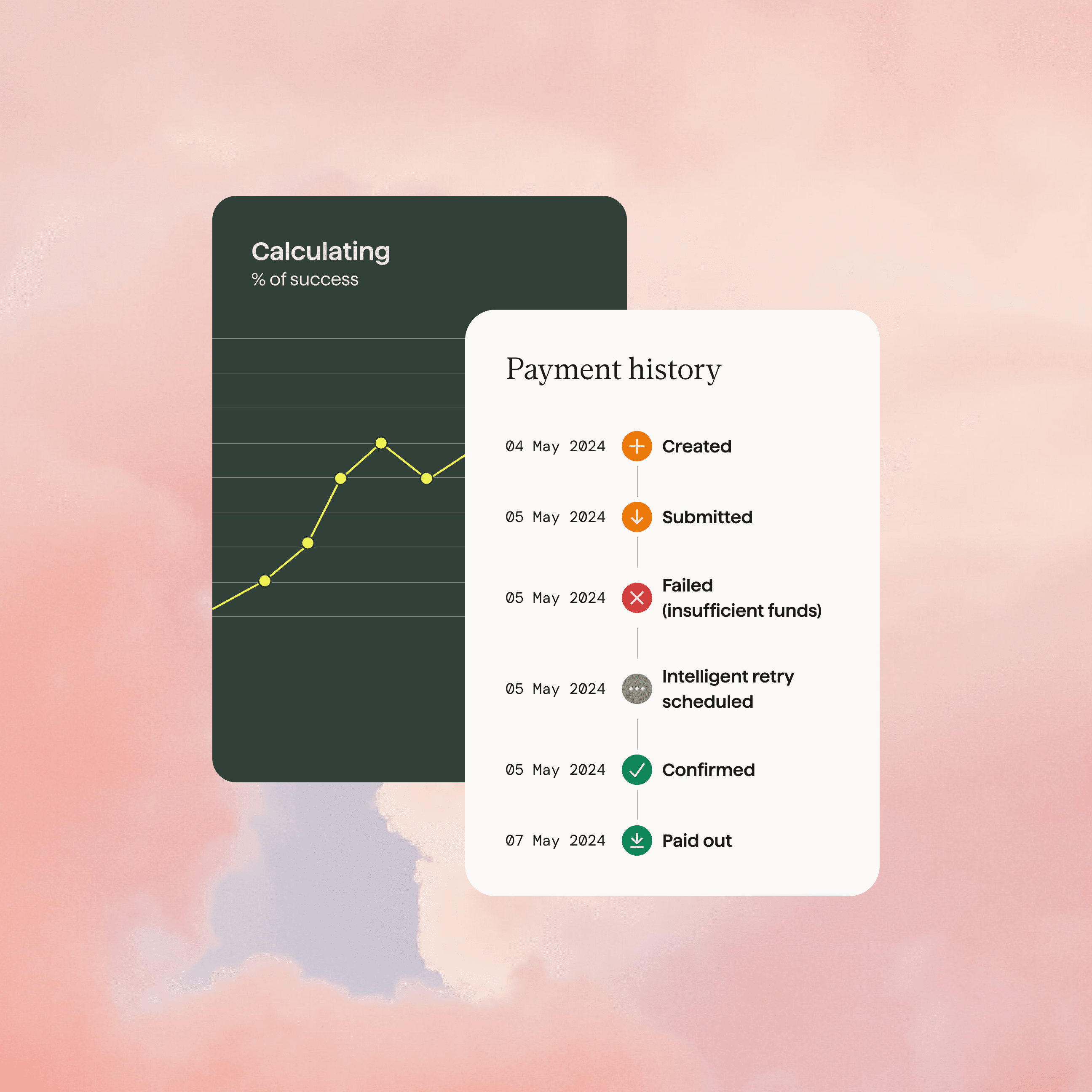

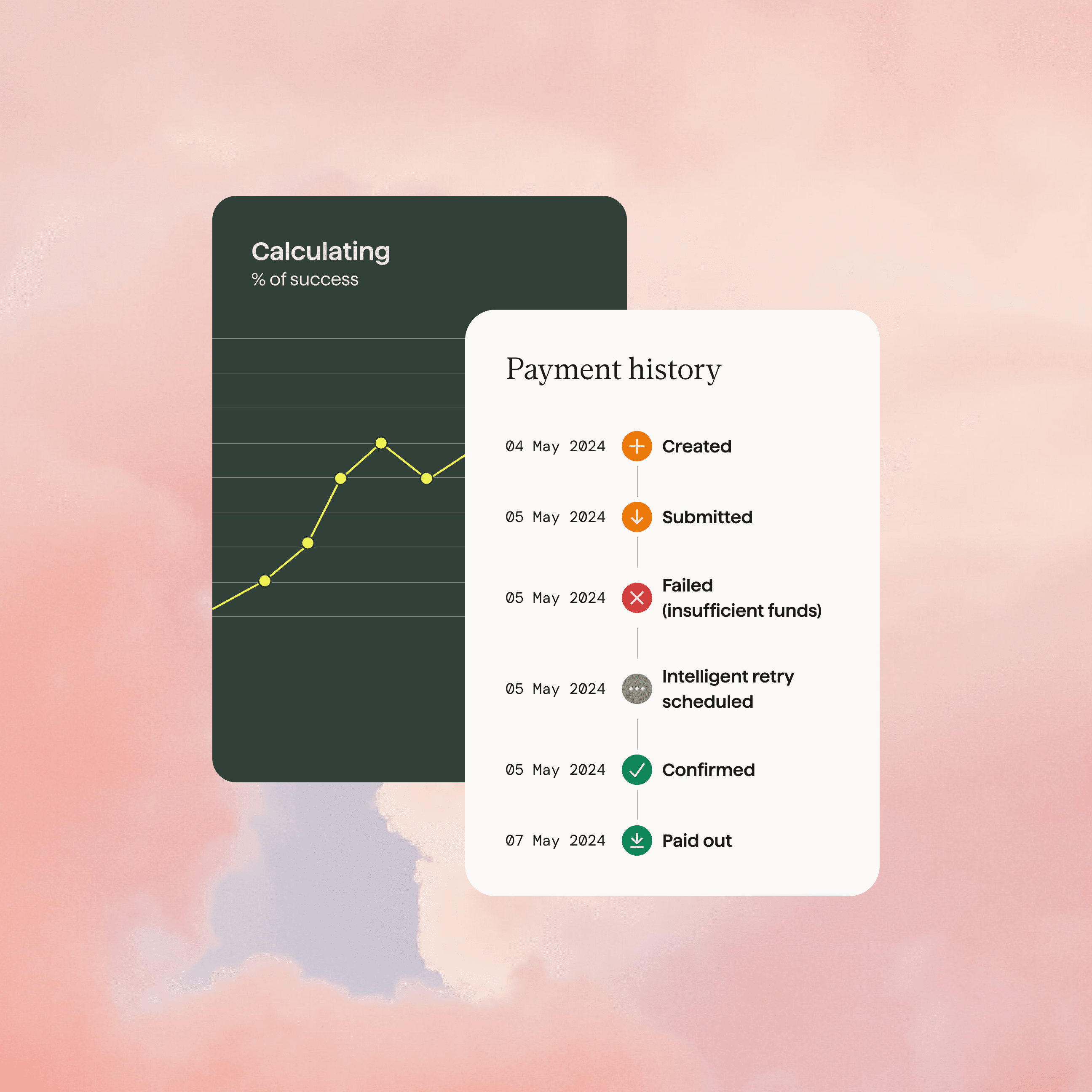

97.3% payment success

With GoCardless, you have a 97.3% chance of a successful payment, first try.

Intelligent payment retries

Reduce your failure rate by a further 15% with Success+, which uses recurring intelligence to schedule

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-NZ] nwe-code_summary_block-secondary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/9bac41ad2f6c3bb241cd59ec6eb96172/code-example-en-nz.png?w=670&h=670&q=50&fm=png)

![[en-NZ] nwe-code_summary_block-secondary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/9bac41ad2f6c3bb241cd59ec6eb96172/code-example-en-nz.png?w=670&h=670&q=50&fm=png)

Moving to GoCardless was the natural step in our payments evolution to allow us to scale, without payments being the limiting factor.

Chris Latchford, Global Head of Payments Strategy, Funding Circle

Made for payment success

Collect 97.3% of payments successfully, first try. If a payment does fail, sit back and let Success+ schedule another try on the best day for each customer.

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally recognised standard.

GDPR compliant

The GoCardless global data risk management program is built to strict GDPR standards and uses privacy best practice to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $35bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

When your engineers actively want to integrate with GoCardless, you know it’s a scalable solution.

Peter Vanhee, Head of Technology, Comic Relief

A robust set of tools and resources

Copy and paste code samples

We’ve worked hard to make building with our API as painless as possible.

Clear documentation

Access Full reference documentation including step-by-step guides.

Expert developer support

Our team of API specialists are on hand to answer queries you might have as you’re building.

Free sandbox environment

Enjoy end-to-end testing in our free sandbox environment.

Trusted by 75,000+ businesses. Of all sizes. Worldwide

Want to learn more?

Speak to one of our experts today about your payment challenges, and see how we can help.