How do online payments via credit or debit card work?

Last editedApr 20237 min read

Credit and debit card payments can be made in person, over the phone, or online and involve several steps with multiple intermediaries, each adding a fee to the cost of the transaction.

How do card payments work?

In this article, we will look behind the scenes at the technical process that facilitates card payments, then examine practical business use cases and how cards typically create payment collection issues. You will learn about:

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule one-off or recurring payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled date. Simple.

How do card payments work?

The process for your business to accept credit or debit card payments online from customers involves several entities and many steps. Before we explore these in further detail, let’s define some key terms:

Merchant account - A type of bank account required for a business to accept credit or debit card payments from customers.

Issuer (A.K.A. issuing bank, or issuing card network) - A financial institution that provides credit or debit cards to its customers. In the context of this guide, think of it as your customer’s bank.

Card association (A.K.A. card network) - A collection of member financial institutions that process card payments based on an agreed set of rules. Major examples are Visa and Mastercard.

Acquirer (A.K.A. acquiring bank or merchant bank) - A financial institution that processes a transaction based on information from the issuer and card association. They provide businesses with merchant accounts and are licensed members of card associations.

Payment processor - A term often attributed with varying definitions. In the context of this guide, a payment processor is the facility of an acquirer which transfers transaction details to the relevant card association.

Payment gateway - Software that facilitates the transfer of a customer’s card details from a merchant’s website to a payment processor. (Like 'payment processor', this term is often attributed to varying definitions, too.)

From the customer completing the merchant’s checkout process through to the merchant receiving the funds in their bank account, the overall process for online credit and debit card transactions takes place in two broad stages:

Authorization

Clearing and settlement

While it’s true that paying with a debit card or a credit card follows the same process - the card details are submitted and digitally communicated to a series of intermediaries to initiate and complete the transfer of funds - there are differences between the two processes.

Debit card processing

Debit card processing involves a payment gateway, payment processor and an issuing bank. There are slightly fewer steps in debit card processing, making it slightly less expensive than credit cards.

Authorization

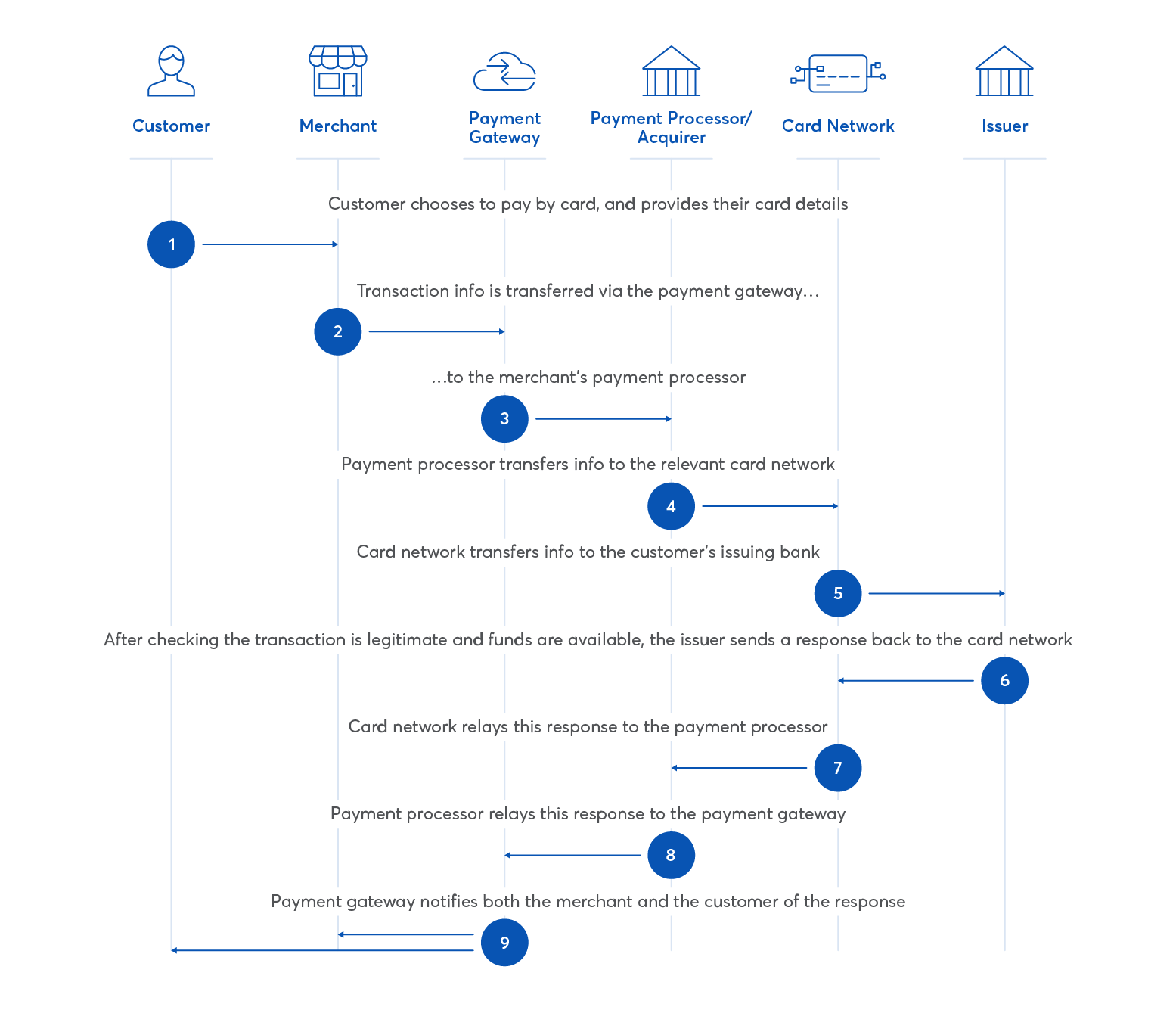

Below is a step-by-step guide to help you understand the stages involved in card payment processing:

The customer completes the merchant’s checkout process and elects to pay via debit card, submitting their card details.

The merchant securely transfers the transaction information (including these card details) to their payment gateway.

The payment gateway securely transfers the transaction information to the payment processor used by the merchant’s acquiring bank.

The payment processor securely transfers the transaction information to the card association.

The card association securely transfers the transaction information to the customer’s issuing bank, which checks if there are sufficient funds to complete the transaction, and also runs checks to ensure the transaction is not fraudulent.

The customer’s issuing bank submits a response to the card association, indicating whether the transaction is approved or declined.

The card association relays this response to the merchant’s payment processor.

The payment processor relays this response to the payment gateway.

The payment gateway informs both the customer and the merchant of the response.

Credit card payment process

With credit cards, the process is similar, however, there is no issuing bank but rather an issuing card network. There are also additional communication steps between the card networks and the payment processors.

To understand why credit card payments are different, it’s important to remember that with debit cards, your own money is being debited from your bank account. With credit cards, you are essentially borrowing the funds from your card network, which you will pay back via your monthly bill.

As a result, it is typically more expensive to process credit card payments than debit card payments.

Clearing and settlement

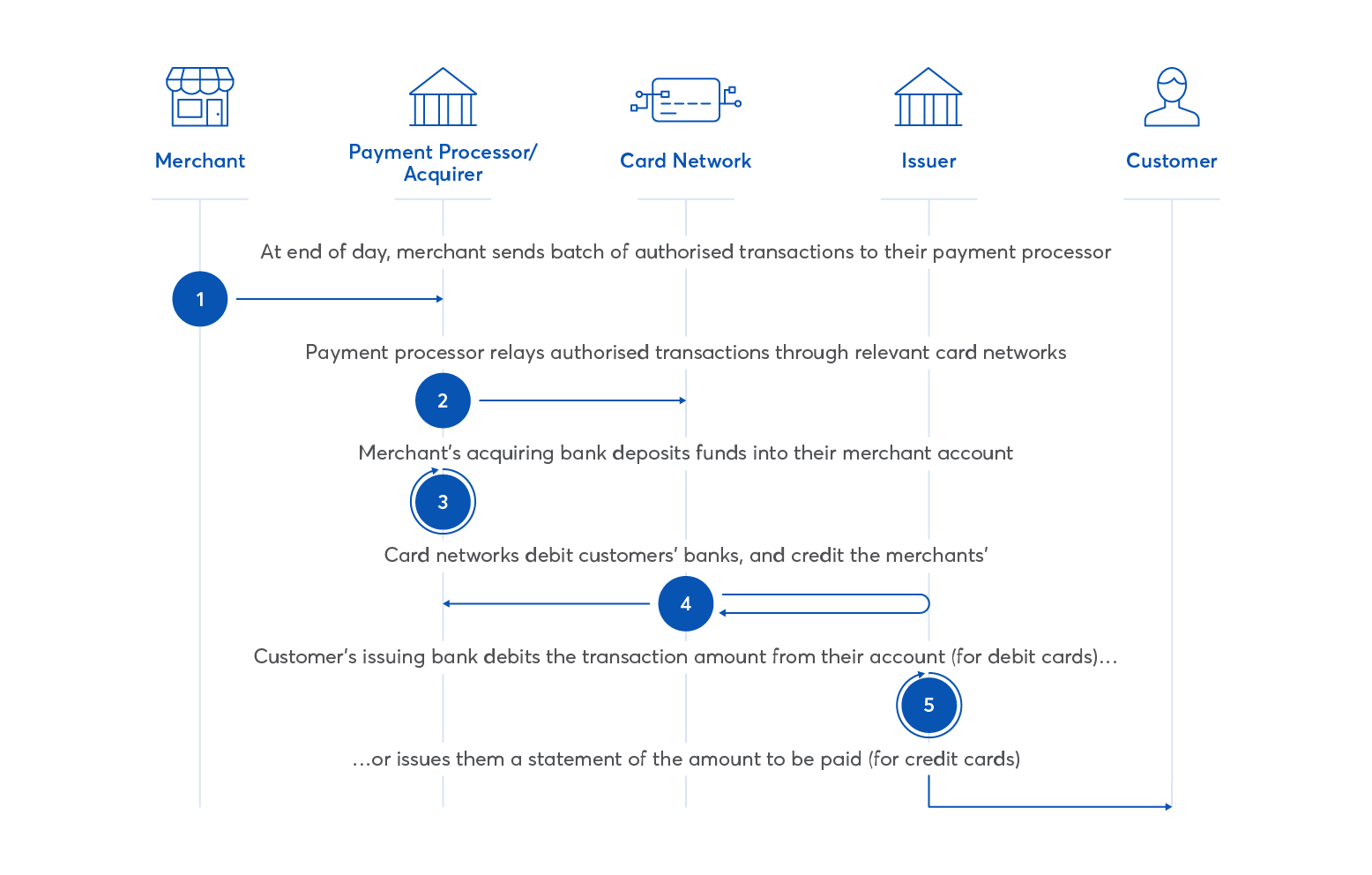

This is the process for the clearing and settlement of debit and credit card payments

At the end of the day, the merchant sends a batch of all authorized transactions from that day to their payment processor.

The payment processor relays these authorized transactions through the relevant card associations.

The merchant’s acquiring bank deposits funds totalling the transaction amounts into their merchant account (deducting any relevant fees).

The card associations (from step 2) debit the customers’ issuing banks for the relevant transaction amounts, then credit the merchants’ acquiring banks (deducting any relevant fees).

The customer’s issuing bank debits the relevant transaction amount from their account (for debit cards), or issues them a statement requesting the amount be paid (for credit cards).

When to accept card payments

Card payments have historically been a very popular way for consumers to pay for goods and services; however, despite their prevalence, cards have few benefits and multiple disadvantages for merchants.

Card payment use cases

The two big advantages of card payments are convenience and speed. The vast majority of shoppers will have a payment card of some description, and it is easy for customers to grab their cards and pay for goods and services online, or in-store via a PoS reader.

Although it can still take a number of days for funds to reach the merchant, confirmation of the transaction is almost instant, offering peace of mind that the transaction will be completed.

Card payments are suited to online eCommerce stores and physical brick-and-mortar stores selling physical goods. Although Open Banking and other developments in financial technology mean that direct account-to-account payment methods offer alternatives, cards are still an integral part of the payment mix for these merchants.

Disadvantages of card payments

Cards have been a very common way to make purchases for some time, but that doesn't mean they offer businesses the best solution for payment collection. In fact, cards have a number of features that cause issues that

High failure rate

Cards tend to have a high failure rate of 10 - 15% compared to under 5% for bank payment methods.

Although the number of intermediaries and steps in the processing journey can cause issues, card payment failure is generally a result of a card that has been lost, cancelled or expired.

All cards, even if not lost and cancelled, will expire after about 3 years.

If you are collecting recurring payments via cards, you will experience involuntary churn - the loss of customers who would have continued paying for the service but for card failure issues.

Coupled with this is the fact that cards offer little in the way of security and are susceptible to both online and offline fraud. Forbes reports that 33% of SMEs have been severely impacted by credit card fraud and that almost 50% of American adults have been victims of credit or debit card fraud.

No visibility

Dealing with card providers is a notoriously difficult business when things go wrong. With card payments, merchants have little visibility of payment status - what has been paid, what has failed, what is pending?

This means that merchants are often required to log in to their bank accounts and manually check that payments have been received. With little visibility on payment status, financial planning is difficult, time spent managing payments increases, and cash flow issues are more likely.

Increased admin

Card payments create a lot of financial admin. Payments have to be manually checked and reconciled. The high level of failed payments with cards also creates a significant amount of failed and late payment admin, with significant time and money costs to recover these payments.

Expensive transaction fees

Accepting card payments is relatively expensive compared to bank payment methods due to all the intermediaries required to process these payments.

Not only are transaction fees high, but pricing is variable. Each card network will have different fees, as will their processing partners. As a result, it is almost impossible for merchants to know in advance how much they will pay for any transactions as it will depend on many factors, starting with the customer’s card issuer.

Alternatives to card payments

For e-commerce and retail brands, cards are an essential part of the payment mix, however, for service businesses that send invoices and companies that collect recurring subscriptions, there are better options.

Bank payments offer flexible and reliable payment collection that is also highly secure. With bank payment methods, businesses own their payment collection and are able to collect one-off and recurring payments on the scheduled dates at much cheaper rates than card payments.

Bank payment methods

Bank payments are well suited to recurring subscription and invoicing businesses and offer several advantages over card payments.

1. More affordable

Bank payments are direct account-to-account transfers between banks with no intermediaries required. As a result, pricing is more affordable and more transparent. Indeed, card transaction fees can be over 3x more expensive than direct bank payments through GoCardless!

On average, credit card fees range between 1.5% - 3%. Exactly how much you'll pay will depend on the card network & your specific fee structure. Not only is GoCardless cheaper, but we also provide pricing transparency.

Accepting a $500 card payment will cost a merchant between $7.50 and $15.

However, with GoCardless, that transaction costs just $2.50.

See our pricing page.

2. Higher payment success

Bank accounts cannot be lost and do not expire. Removing the primary reasons for payment failure means that merchants using GoCardless to collect payments enjoy a payment success rate above 95% on the first payment collection attempt.

3. Good payment visibility

GoCardless also provides a significantly higher level of visibility on payments - merchants receive notification from GoCardless in the unlikely event that a payment fails. Furthermore, the merchant dashboard provides visibility on payment status - which payments are due, which have been collected and which are pending.

4. Eliminate late payments

Bank payment methods such as ACH Debit are 'pull' payments controlled by the business collecting the payment. The customer authorizes the business to pull payments from their account on agreed dates. The payment is automatically pulled from the customer account on the due date without the customer having to take any further action.

5. Automation reduces admin

GoCardless integrates with over 200 different accounting software packages allowing time-saving automation.

Recurring and invoice payments can both be automated, as can reconciliation and other aspects of financial admin. Additionally, the reduced level of late and failed payments eliminates credit control requirements and associated late payment admin.

As a result of automating payment collection processes, GoCardless merchants spend 59% less time managing payments.

We can help improve your payment collection process

Collecting payments through bank payment with GoCardless is more affordable and more secure, with higher success rates and a lower level of admin, than accepting card payments or chasing up late invoices.

GoCardless helps you automate payment collection, reducing transaction costs and the amount of financial admin your team needs to deal with when collecting payments.

Learn more about how GoCardless can save you time and money on payment collection.

Case Study: How Diaper Stork saves time and money with direct bank payments and GoCardless

Using GoCardless has enabled Diaper Stork to reduce payment costs, with the company now paying 2% less per transaction than cards for every customer that chooses to pay by bank payment.

As well as monetary savings, automating financial admin has further saved the business 2 - 3 hours a month in accounting time, allowing them to focus on improving the customer experience.

Learn more about how GoCardless can save you time and money on payment collection.