Cash flow

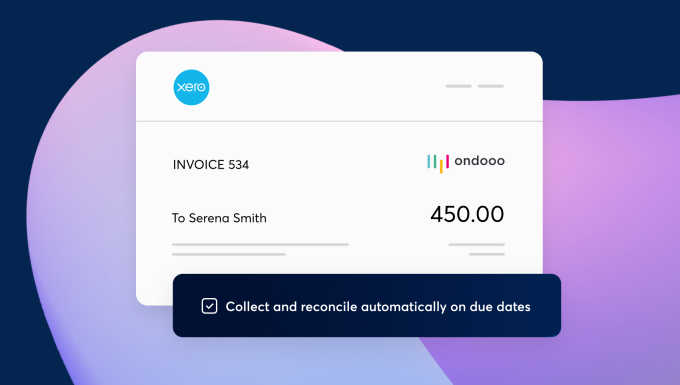

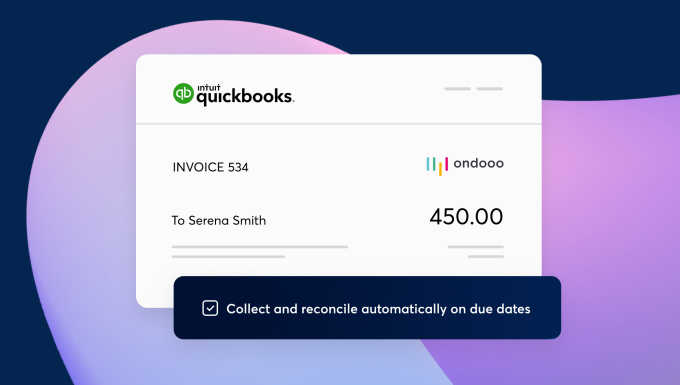

We look at how to optimise your invoice process to facilitate cash flow.

Learn how to do a cash flow budget and why it’s important for your business.

Where does your business stack up? Find out here.

Can you record deferred revenue before receiving cash? Here’s how.

Understanding how to increase online donations is crucial for nonprofits.

Businesses rely on strong cash flow – a speedy cash flow is a strong cash flow.

Improve your cash flow to maximise your income and minimise your admin time.

The UK government is reviewing the Duty to Report. We believe it should stay.

Will open banking or Account-to-Account payments simplify your payments process?

Cash inflow quite literally refers to any money going into a business.

Discover the solutions to seasonal cash flow problems.

We explore how your repayment terms can make or break your cash flow

Quote to cash takes you from customer interest to company revenue.

Improve cash flow and learn how to reduce debtor days.

Fight traffic cart abandonment in your online store.

Discover how your payment strategy plays an important role in cash flow.

Discover the benchmarks for global payment timings from the latest research.

![[Report] The global payment timings index 2021](https://images.ctfassets.net/40w0m41bmydz/5ub7ZuljD6oXChFKiOCWkk/77fd9d1233e5a62b348fd13f9e551baa/BDT-1626_blog_header_22.jpg?w=680&h=385&fl=progressive&q=50&fm=jpg)

How quickly does your business get paid compared to the industry benchmark? We looked at over 40 million payments from 65,000 businesses to find out.

Learning how to make passive income can bolster your financial profile.

Learn how to read and interpret the cash flow statement with our guide.